WESTMONT, Illinois (February 12, 2024) – LifeQuotes.com, the online life insurance price comparison service that offers instant quotes from 50 highly-rated life insurers, today released the results of a new life insurance survey that confirms consumers with type 1 or type 2 diabetes have open to them a wide range of cost-effective life insurance plans.

“We have great news to share with diabetics who are shopping for life insurance,” said LifeQuotes.com Executive Vice President Brian Bland. “We track the rates and underwriting guidelines of 50 life insurers and our salaried agents are trained in how to advise diabetics and in finding the best policy fit for any given diabetic history.”

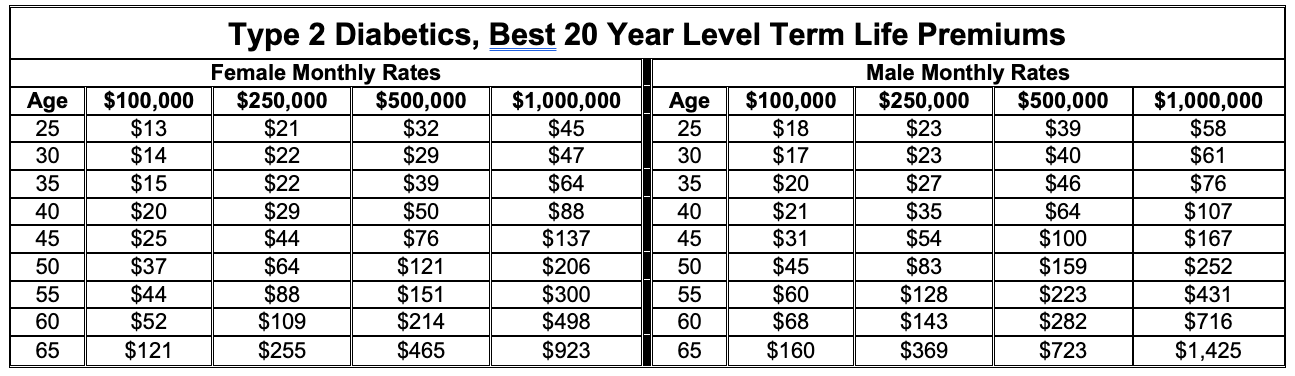

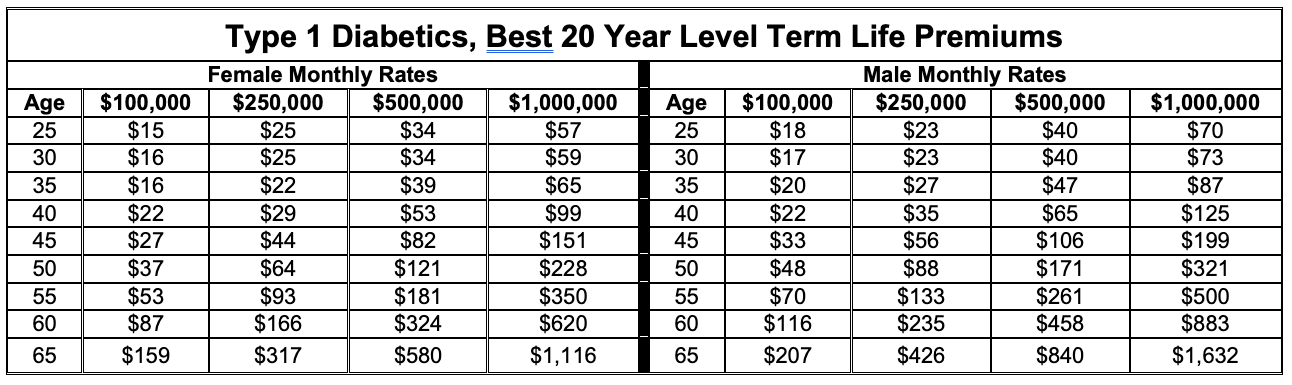

The charts reveal the best possible monthly prices for type 1 and 2 diabetics for the #1 most popular 20-year level term life policy that covers death by any cause, at any time, in any place, except for suicide within the first two policy years (one year in some states). Beneficiaries received benefits tax-free. Other rate guarantee plans such as 10, 15, 25, 30-year and level-for-life are available at www.lifequotes.com.

Some sample rates shown offer a possible instant decision with no medical exam required. These plans are renewable, without evidence of insurability, to age 90+, and some are convertible to permanent insurance without having to undergo further underwriting.

Continued Bland, “Our 50-insurer database is continually updated, which makes it a valuable resource for diabetics who are searching for the best buys in life insurance.”

All sample premiums shown require a signed application, a review of the applicant’s medical records, and acceptance by each underwriting company. In some cases, a paramedical exam will be requested; however, for applicants with well-controlled diabetes, it’s possible to skip the exam and receive an instant decision offer of insurance in one phone call.

According to the CDC, there are two main types of diabetes: type 1 and type 2. Type 1 develops when the immune system destroys pancreatic beta cells – the only cells in the body that make insulin, a hormone that controls blood sugar. People with type 1 diabetes typically receive regular insulin via injection or pump. Type 1 diabetes usually strikes children and young adults, and accounts for 5-10 percent of diabetes diagnoses.

The other 90-95% of diabetes cases in the US population are type 2, which usually starts as insulin resistance, where cells do not respond to insulin properly. The pancreas then produces excess insulin, attempting to trigger a response, but eventually, insulin production decreases and blood sugar rises.

Diabetes Leads to Shortened Life Expectancy

Medical research shows that people with diabetes die, on average, 6 years earlier than people without diabetes. The earlier the diagnosis, the shorter is the expected lifespan.

According to The Lancet, (Diabetes & Endocrinology, September 2023), research suggests that, for those surviving to at least 50 years of age, those diagnosed with diabetes at age 30 will die an average of 14 years earlier than individuals without diabetes; 10 years earlier when diagnosed at age 40; and 6 years earlier when diagnosed at age 50. Interpreted another way, every decade of earlier diagnosis of diabetes has been associated with 3-4 years of lower life expectancy.

According to the American Diabetes Association, nearly 37.3 million Americans have a diagnosis of diabetes while 96 million have prediabetes. On average, 1.4 million Americans are diagnosed with diabetes each year.

Around 1.6 million Americans have the more-serious type 1 diabetes, with 64,000 newly diagnosed cases per year, according to the Centers for Disease Control and Prevention (CDC). The average life expectancy for people with type 1 diabetes has reduced from 77 to 66 for men and 81 to 68 for women.

Recent Success Stories

Life insurers vary widely on how they underwrite applicants with diabetes, which underscores the importance of shopping around and choosing to work with a knowledgeable agency that represents many insurers.

- Alan M. of McClean, VA, type 2 diabetic, age 62, weight 290 lbs, history of heart attack, was able to buy a $500,000 policy for $2,952 per year

- Casie C. of San Antonio, TX, type 2 diabetic, age 41, weight 150 lbs, history of anxiety on Xanax, able to buy a $500,000 policy for $410 per year

- John P. of Orange, CA, type 2 diabetic, age 46, weight 256 lbs, history of heart disease with abnormal EKG, complications of Long COVID, able to buy a $300,000 policy for $1,579 per year

- Anura B. of Draper, UT, type 2 prediabetic, age 35, weight 135 lbs, able to buy a $1 million policy for $410 per year

Michelle Zieba, vice president of Sales, offered this advice to diabetics who are shopping for life insurance, “Diabetics can do a lot to prepare to buy life insurance. Know your date of initial diagnosis, know your recent A1c history and have an accurate list of your doctors ready. Because our illustrations list each plan’s acceptance guidelines, expect to spend a few minutes with our salaried agents on which plan best fits your health profile and budget. These steps will ensure you get the lowest possible pricing.”

Instant life insurance quotes for both type 1 and type 2 diabetics are available at www.lifequotes.com. Customers can now quote anonymously and buy online in total privacy or obtain personalized service and advice from our licensed phone agents.