Life insurance can be a superb savings and investment vehicle. All conventional investment vehicles serve the same purpose, but the unique feature of life insurance is that it assures a desired accumulation at a specific, but uncertain time; namely at the time of the insured’s death. No other savings or investment tool makes such a guarantee.

If the time of death were certain, life insurance would be unnecessary. A person could accumulate any desired target amount by investing in a traditional investment vehicle and employing a systematic plan of saving, or what is called a “sinking fund.” For example, if a person’s objective is to accumulate $1,000 in five years and he or she could be assured of surviving that long, this person could simply invest a specific lump-sum amount today in a traditional investment vehicle that with interest would grow to $1,000 in five years.

Example. If $620.92 is invested today at 10 percent interest, the fund will grow to $1,000 in five years. Alternatively, if this person does not have $620.92 to invest today, he or she could finance the accumulation over time, for instance, by investing $148.91 at the beginning of each year for the next five years. However, if this person died any time before the end of the five-year period, the amount accumulated at the time of death would be less than the desired $1,000.

Most discussions of life insurance describe it as a combination of “pure death protection” that decreases and “savings” or “investment” that increases over a person’s lifetime. This perspective can be useful for some discussions of the nature of life insurance, but it also can be confusing and misleading. Life insurance, when viewed in its entirety, is also a special type of investment or accumulation vehicle that uniquely matures at death.

The bifurcation of a life insurance policy into its “death protection” and “savings” elements can be useful if it is understood for what it really is. The savings component is the noncontingent part of the overall investment accumulation that is available not just at death, but also during life, similar to any conventional investment or savings instrument.

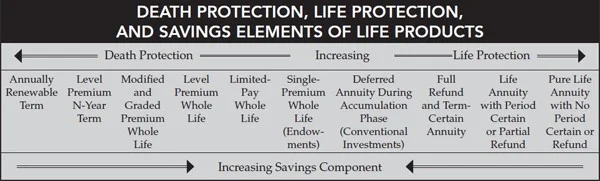

The relative size of these two components depends on the life product and how the life insurance is financed. At one extreme is annually renewable term insurance, which is essentially 100 percent pure death protection and 0 percent savings. At the other extreme are deferred annuities during the accumulation phase (and other conventional investments), which are essentially 0 percent pure death protection and 100 percent savings. The other life insurance products fall somewhere between these extremes.

Making the distinction between the “pure death protection” and “savings” components actually ignores half the spectrum of “life” products. In a manner analogous to life insurance, annuities may be described as a combination of “pure life protection” and “savings” elements after the annuity starting date. The savings component of annuities is the noncontingent part of the overall investment that is available regardless of whether one lives or dies, similar to any conventional investment or savings instrument. In other words, the savings component is the guaranteed or refund amount provided by some annuities that is payable even if the annuitant dies. The pure life protection component is a contingent investment that matures or is available only if the annuitant lives. At one end of this spectrum is full-refund or term-certain annuities (or conventional investments) that are essentially 100 percent savings and 0 percent pure life protection. At the other end of the spectrum are no-refund life annuities that are 0 percent savings (theoretically) and 100 percent pure life protection.

The figure above shows how various “life” products from term insurance to annuities fall within the pure death/life protection and savings element spectra. But keep in mind that both components make up the total investment. Any assessment that evaluates the “investment” potential of a life product by looking only at the savings element (the amounts that are available regardless of whether a person lives or dies) ignores the fact that the pure death/life protection component is properly viewed as a type of contingent investment that matures or is available only when the death or life contingency occurs.

Reproduced with permission. Copyright The National Underwriter Co. Division of ALM